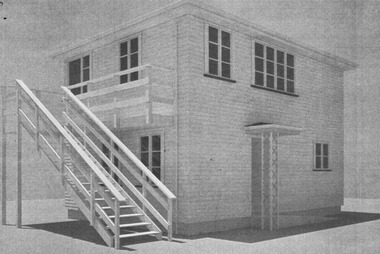

On the one hand we have a sculpture of a hou se now scaled down to cost a mere $1.5 million, a mere ornament which the council intends to buy

se now scaled down to cost a mere $1.5 million, a mere ornament which the council intends to buy

On the Other hand we have a real house , a home to at least three people and two cats worth less than $700,000.Which the council is going to forcibly sell .

Then there is a rates bill of some 13,000 which was not paid out of protest to a very one sided contract where by Council was not keeping up their end of the agreement where by they were to engage in open transparent and democratically accountable governance.

While the council are prepared to pay over the top for one they are willing to sell the other because a pittance is owed. Ironically this is exactly why Penny withheld her rates.

Penny Bright withheld her rates until the books were opened just as Auckland transport has managed to do see here

So the $13,000 in arrears rates have attracted over $20,000 in penalties. this prompted us to have a closer look at what is going on with our rates and it appears that Auckland rate payers are held accountable to rate penalties in a very strict manner , pay a day late on any instalment and you pay 10% more ,On the other hand Auckland council is manipulating the law and in other instances being totally non compliant.

In going through the law and the detail we have discovered a number of things which are worthy of question , especially when the houses which we once bought for tens of thousands are now worth hundreds of thousands and wages have remained static.

Let us you through it , this is the way we see it .

The applicable legislation is the Local Government (Rating) Act 2002 and the ability to include penalties comes from a two step process by council .

- There needs to be a decision by council , this may be delegated but has to me made before the rates are set

- The decision made must comply with the law and

- Must not exceed 10% of the amount of unpaid rates on the date when the penalty is added

- may be of the types of penalties as set out in section 58 being

-

a) a penalty on rates assessed in the financial year for which the resolution is made and that are unpaid after the due date for payment (or after a later date if so specified):

-

(b) a further penalty on rates assessed in any financial year and that are unpaid on whichever day is the later of—

-

(i) the first day of the financial year for which the resolution is made; or

-

(ii) 5 working days after the date on which the resolution is made:

-

-

(c) a further penalty on rates to which a penalty has been added under paragraph (b), if the rates are unpaid 6 months after that penalty was added.

-

The way that we interpret this is that these options are available and are the only legal options available IF it is contained in the decision by council.

We went in search of the decision which Auckland council had made and found it in the 2014-15 annual Plan Volume 1 – Our Plan for 2014/2015 for ease we have isolated the pages concerned they are found here rates related policies

Penalties on rates not paid by the due date

The council will apply a penalty of 10 per cent of the amount of rates assessed under each instalment in the 2014/2015 financial year that are unpaid after the due date of each instalment. Any penalty will be applied to unpaid rates on the day following the due date of the instalment.A further 10 per cent penalty calculated on former years’ rate arrears will be added on the first business day of the new financial year (or five days after the rates resolution is adopted, whichever is the later) and then again six months later.

Spot the difference ?

Auckland council imposes penalties on each installment where as the act applies it to the rates assessed in the financial year and does not speak of penalties for parts of rates .

The rates are set for a financial year in this case being 1 July 2014 to 30 June 2015 in the rate assessment which we have before us is for $4510.81.

There is an ability to pay it by instalment , or pay the lump sum which gives a saving of a whole 1.1% . $4461.18. a saving of a whopping $46.63

Relevant here is Section 24 Due date or dates for payment, in the interpretation section due date, is defined as : in relation to a rate or part of a rate, means the last day for payment of the rate, or part of the rate, that is set out in the rates assessment

The question has to be : can “ a penalty on rates assessed in the financial year for which the resolution is made and that are unpaid after the due date for payment” be interpreted to mean a part rate ?

The assessment notice reads total rates payable 2014/2015 is $4510.81 to us this means that by 30 June 2015, $4510.81 needs to have been paid being the financial year as determined by 45 (1) (j). and most importantly 45 (1) (k) which states “the total amount of rates payable on the rating unit for the financial year”

while Auckland council asks for the payments to be made by four equal installments , the overall obligation is to clear the rates due in that financial year .

The regime should be more in line with retail being

- the price which is due on the due date .. in this case $4510.81 by 30 June 2015

- the discounted price if paid in its entirety early, this is usually heavily discounted

- The price if paid by installments which should be equal to or as an incentive less than the demanded price

At all times the right to pay the full rates demand by the 30th June in one payment should remain an option as that way you are payign your entire rates in the year that it is due.

If you were to pay it in a lump sum under the Auckland council regime , and still be complying with legislation you would incur penalties of $338.10 ( being as stated on the notice $122.70 per installment ). Compare the extra penalties for being complaint with the law to the savings for paying early one gives you a penalty of $33.10 the other a saving of just $46.63 a difference of $291.47, so why is the money in Auckland councils pocket worth more than in yur pocket.. should it not be at least equal ?

more in part 2 the juiciest is yet to come.

Leave a Reply